Buying a home can be complicated.

We’re here to help.

NeighborWorks Lincoln’s homeownership program is here to take away some of the mystery behind home purchase, and, for eligible buyers, provide down payment assistance and rehabilitation funds to help Lincoln families purchase their first home! The homeownership program has three key components:

- Homebuyer Education

- Down Payment Assistance

- Rehabilitation Assistance

Ready to start your homeownership journey? Apply today.

HOMEBUYER EDUCATION

NeighborWorks Lincoln provides a HUD-approved pre-purchase course designed to prepare you for home ownership. The Homebuyer Education program is a series of four (4) in-person classes, typically held on the second and third Wednesdays and Thursdays of each month, from 6 p.m. to 8 p.m.

During the Homebuyer Education course, you will learn how to:

- analyze and manage finances, budget, and credit;

- evaluate housing affordability;

- work with realtors and banks;

- understand financial paperwork, closing costs, and the home buying process; and

- determine the amount of money needed for home purchase.

Homebuyer education is available for all Lincoln residents, regardless of income.

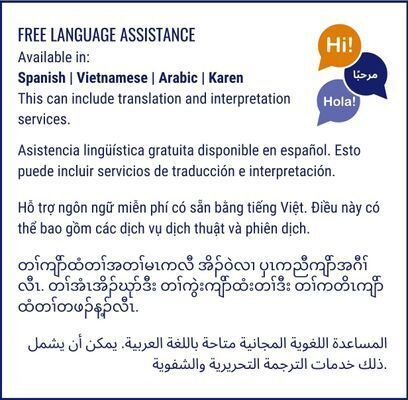

Due to program popularity, clients must sometimes wait 1 to 3 months before being accepted into a course. NeighborWorks maintains a waiting list, though, and clients are contacted when a spot is available. All adults in the household must attend all four (4) class sessions. If you have special needs or would be more comfortable in a course provided in a language other than English, please let us know and we will make the appropriate accommodations.

VIEW HOMEBUYER EDUCATION CALENDAR.

DOWN PAYMENT ASSISTANCE (DPA)

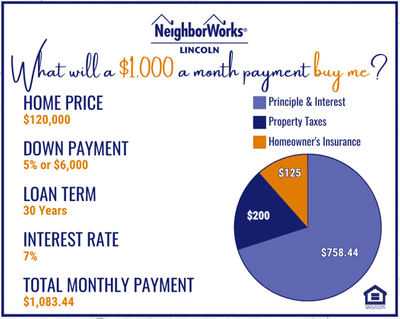

NeighborWorks Lincoln provides DPA to help with the required down-payment and closing costs that go along with purchasing a home. The assistance amount varies per family and is based on the purchase price of the home as well as household income. Qualified borrowers can purchase existing homes anywhere within Lincoln’s city limits, but special incentives are available to buyers who purchase homes in specific neighborhoods. Financial assistance also covers a limited rehabilitation scope typically focused on structural repairs or upgrades that will help avoid unexpected maintenance for the first three (3) years.

Down payment assistance is provided through an interest-free, payment-deferred loan. This assistance loan covers a 5% down payment and closing costs associated with the purchase of the property. Payment on the loan is due upon sale of the property or if the program participant no longer uses it as their primary residence. Down payment assistance amounts and loan forgiveness rates are determined by the location of the property. The program allows a maximum purchase price for an existing home of $247,000 as of September 1, 2024. (This figure is established in partnership with HUD and is non-negotiable).

Down payment assistance is not guaranteed to all applicants and is based on eligibility and funding availability.

SEE IF YOU MEET ELIGIBILITY REQUIREMENTS.